Biden Uses ESG to Devastate the American Economy

Long ago, your Mom told you never to discuss money, death, or religion in public. She said it was for the same reason you did not brag: it made those without what you had feel bad. Some have money, most do not, and only some people can “get” religion, which makes the others feel left out.

Talking about money still feels dirty. It seems like we reduce life to these little pieces of paper and metal, then forget about anything else. But as Marx told us, time is money. Specifically, our time is given to generate money, and then that money gets taken from us.

One way it gets taken from us is taxes, of course. Another is raising prices by raising costs. All costs get passed on to the consumer, so when taxes, Affirmative Action, unions, COVID-19 lockdowns, or DEI/ESG/CEI come knocking at the door, the end consumer pays.

Like his inspiration Jimmy Carter, Joe Biden has shifted the burden of government onto private industry through regulations. Government does not want to fund DEI, so it forces big investment firms to take it into account. A high CEI score staves off EEOC and civil rights lawsuits.

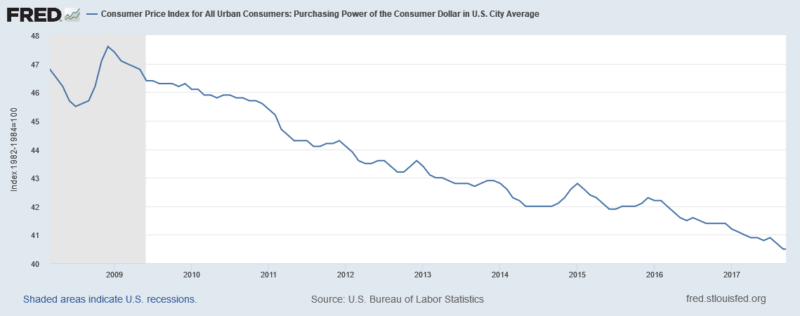

Under Barack Obama, our currency seemed to lose about two-fifths of its value in terms of what it bought and the quality of what was bought. During those years, people had to abandon the old brands — the big corporations who are subject to government manipulation — in order to find the same quality.

Similarly, under Brandon package sizes have gone down, filler ingredients have gone up, and prices have risen to accommodate the huge burden he has in the best socialist style shifted to industry. Why not? It weakens industry, strengthens government, and makes more desperate people who cluelessly vote Leftist.

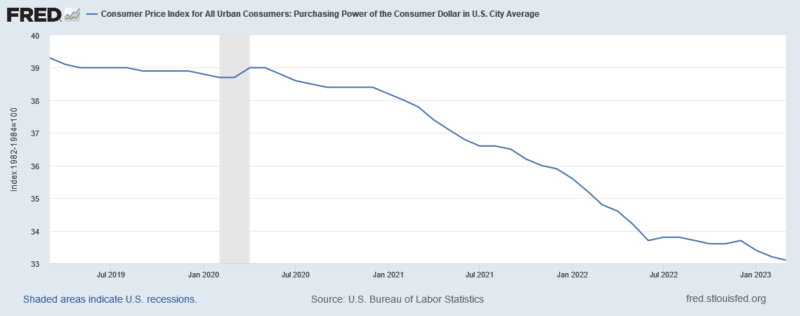

If you look at the Consumer Price Index, consumers are paying higher prices for lower quality since the dawn of the Biden years.

It also shows us how the diversity recession and 0bama years produced a downward trend in the value of our currency that was barely being contained and slowly starting to reverse during the Trump years:

Following the Carter template, Biden continues his wrecking-ball inertia by encouraging equality scores which turn major corporations into mouthpieces for democracy, equality, individualism, diversity, and socialism:

At stake is their Corporate Equality Index — or CEI — score, which is overseen by the Human Rights Campaign, the largest LGBTQ+ political lobbying group in the world.

HRC, which has received millions from George Soros’ Open Society Foundation among others, issues report cards for America’s biggest corporations via the CEI: awarding or subtracting points for how well companies adhere to what HRC calls its “rating criteria.”

Businesses that attain the maximum 100 total points earn the coveted title “Best Place To Work For LGBTQ Equality.” Fifteen of the top 20 Fortune-ranked companies received 100% ratings last year, according to HRC data.

It turns out that the people behind the investment funds which enforce this ranking on corporations are the fellow travelers who buy into the idea of White Replacement as good and therefore, are most concerned with cultivating the nü-American audience:

They name BlackRock, Vanguard and State Street Corp., which each own up to 5 percent of most major US companies, as the ones doing the strong-arming, which Ramaswamy called “a protection racket.”

The big asset companies like BlackRock, Vanguard and State Street Bank are shareholders of almost every Fortune 500 company and if they vote for a policy, CEOs who do not comply open themselves up to potential legal issues because it could look as if they are not acting in the best interest of shareholders, several anti-ESG analysts told The Post.

“It’s a protection racket,” Ramaswamy told The Post Wednesday. “If company executives don’t go along with it, they could see their compensation cut or their bonuses disappear and the chance of further investment from the big three funds could go away.”

Government makes rules like Environmental, Social, and Governance standards for funds and other large companies, which means that those who want to avoid penalization and accept government investment or contracts need to start toeing the line:

The regulation, which took effect in January, applies to so-called “environmental, social and governance” funds.

These ESG investments — also known as sustainable or impact funds — come in a variety of flavors. Fund managers might funnel money into green-energy firms or companies with diverse corporate boards, for example.

The Biden administration rule unwound a regulation issued by the Trump administration, which effectively barred employers from selecting ESG funds for their company 401(k) plans, experts said.

The 0bama and Biden administrations favor ESG funds, which means they are more likely to support ESG investors. Even more, those who fail to invest in ESG run the risk of being investigated by a compliant IRS or other federal agency looking for excuses to beat down the non-compliers.

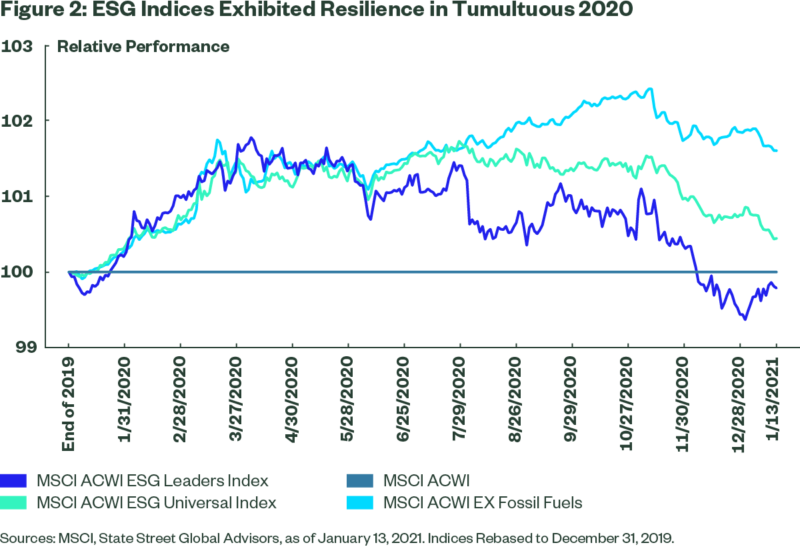

How profitable is it to switch to ESG-based investing during a Leftist administration? It determines the difference between mediocre profit and dominating industry:

As we enter Biden’s term, investors may expect a closer link between ESG and profitability/social externalities. Biden’s new policies will come on top of data showing that sustainable and ESG equity indices outperformed conventional indices during spikes of volatility in 2020.

In November, the DOL released its final rule on ESG investing, entitled “Financial Factors in Selecting Plan Investments.” While the precise future of the rule is uncertain, the new administration could view the consideration of ESG factors more favorably and seek to reconsider the DOL’s regulation and its position on ESG adoption by retirement plans, enabling defined contribution plans to more assertively factor in ESG criteria. Exhibiting a shift in leadership in the DOL, Biden has appointed Boston, Massachusetts Mayor Martin J. Walsh to succeed Eugene Scalia as Secretary of Labor.

ConclusionAs we discussed in our paper, “The New Normal: ESG Investing in 2021,” we expect ESG to become more prominent on multiple dimensions, most notably in the US. While it’s too early to accurately determine Biden’s impact on ESG Investing, US investors should be prepared for a significantly greater focus and prioritization of ESG polices in the coming months and years. And the support from the US may provide additional heft to global efforts.

This is consistent with other 0bama-Biden uses of regulations to force the markets to comply, effectively making private industry a fourth arm of government, such as their recent electric vehicle mandate:

The EPA lacks the legal authority to mandate EVs, but it will do so indirectly by setting CO2 emissions standards for 2027 through 2032. The standards are so strict that auto makers must electrify their fleets to meet them. Under the proposed rules, EVs would account for about two-thirds of light-duty vehicle sales in 2032, up from a mere 6% or so last year.

The EPA mandate is even more aggressive than President Biden’s August 2021 executive order, which set a goal of 50% EV sales in 2030. EPA says at least 20 countries have announced plans to phase out internal-combustion engine cars in the coming decades, so its proposal is no big deal.

“In February 2023 the European Union gave preliminary approval to a measure to phase out sales of ICE passenger vehicles in its 27 member countries by 2035,” EPA says. It conveniently ignores that the European Union last month walked back the ban amid concerns about its enormous costs.

Leftists, as what are essentially narcissists, prove to be very clever about manipulation. They can force the system to do what they want without using the ostensibly correct procedure, and these indirect manipulations are missed by most of the voters, even most conservative ones.

They ignore consequences because their only goal is a method, namely placating the audience so that Leftists can enjoy successful and perpetual rule. Not surprisingly, transferring trillions of dollars from areas where it produces profit to dead-end government agendas kills the economy and currency.