“Experts” Do Not Understand The Effect Of Immigration On The Economy

We live in an age of death which is worse than an empire of lies. It is an empire of false assumptions because we based what we consider “truth” in what others will recognize as a group, not what our best people understand. This is a hazard of rabble revolts and does them all in hard.

An assumption that we rely on is that, in order to compete with other civilizations, we need as much diversity and immigration as possible because it strengthens our economy and technological advantage. In our tech firms, H-1Bs are considered the way forward, and in industry, third world labor has become essential.

Cynical politicians know that the average voter cares only about how the economy is doing in the few months before a vote. If some proposed plan delivers them more money in that time, they will vote for it and assume that it is as advertising. When, many years later, the plan causes some kind of crisis, voters will ignore their earlier support.

The immigration/diversity lobby takes advantage of the blindness of voters and the assumption that immigration is in fact good for us. Its first task is to give people plausible reasons for wanting immigration that also serve to conceal their actual reasons for wanting immigration.

For the lower half of the middle class, immigration has been a huge economic boon much as cheap Chinese products were a decade before. In business, the former lower middle class American could hire a dozen Mexicans or other Asians to do the work and pocket the cost savings of their labor.

Consumers enjoyed immigration because it meant cheaper construction, restaurant food, and other services. The average lower middle class American looked up and saw that the rich had maids and lawn services, and with immigration, he can also have those things, albeit at a lower quality level.

However, the question remains as to whether this actually benefited anyone because, as is always the case, any action in the economy has ripple effects which bounce back from distant consequences. If you can imagine ripples in a pool, immigration was a pebble tossed in the middle, and it took a long time for those ripples to hit the shores of the pool and then come back in toward the center.

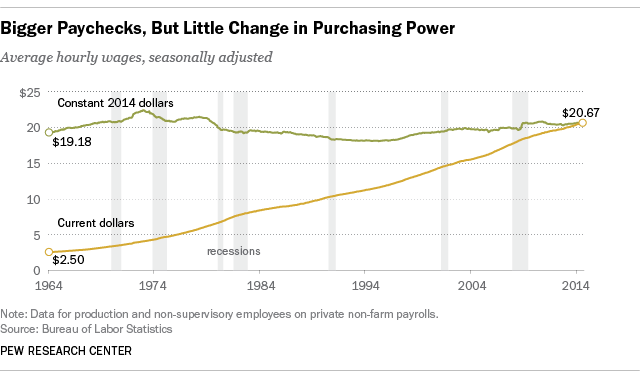

For example, real wages have been stagnant since the time when we adopted third world immigration and the welfare state in the mid-1960s:

For most U.S. workers, real wages — that is, after inflation is taken into account — have been flat or even falling for decades, regardless of whether the economy has been adding or subtracting jobs.

…In fact, in real terms the average wage peaked more than 40 years ago: The $4.03-an-hour rate recorded in January 1973 has the same purchasing power as $22.41 would today.

…56% of Americans said their family’s income was falling behind the cost of living, up from 44% in September 2007 — just before the recession hit.

In the broader sense, immigration has depressed wages because industry is in theory more productive than ever, and yet less of it is trickling down to the employees.

This makes sense because when you add more workers to a country, the law of supply and demand says that wages will go down. Leftists disagree with this notion:

When the University of Chicago’s Booth School surveyed a panel of well-known academic economists, for example, 52 percent agreed that admitting more low-skilled immigrants to the United States would make the average US citizen better off. Just 9 percent disagreed. The panel agreed that more highly skilled immigrants would be good by an even more overwhelming 89-0 margin.

Rather, as Heidi Shierholz of the liberal Economic Policy Institute emphasizes in her overview of the literature, it’s that “earlier immigrants are the group that’s most adversely affected by immigration” because they are the people whose skill sets are most likely to put them in direct competition with new immigrants. Across a range of estimates, the effects on wages “tend to be very small, and on average, modestly positive.”

That’s because, as Michael Greenstone and Adam Looney of the center-left Hamilton Project put it, “immigrants and U.S.-born workers generally do not compete for the same jobs; instead, many immigrants complement the work of U.S. employees and increase their productivity.”

When battling bad assumptions, one has to discard empirical data — which has already been filtered through those assumptions — and focus on logical fact instead. This is a leap that most people fear taking, but data is not separate from its interpretation, and that interpretation colors what is recognized as part of the data set.

Looking at this logically, there is a gap in the reasoning of these Left-leaning economists: while immigrants do not compete directly with existing citizens for jobs, what they do is shift the labor pool upward. The white Americans formerly working in food service, construction, or sanitation are now bumped up into offices, much like the former lower middle class now has the maids and lawn services that were once exclusive to the upper half of the middle class.

This means that immigrants are not competing with American workers, but American workers are experiencing strong competition and displacement from those who previously would not be competing for their jobs, and this drives down the value of labor at every level in the economy.

A natural-born citizen would be hard-pressed to find work in the fields that immigrants now occupy. Leftists will point to the history of America as bringing immigrants in to boost everyone to higher levels of income, but as the data shows us, it simply moves them upward in title while depressing their actual income.

In both skilled and unskilled labor pools, the effects of this have been catastrophic. First, the greater competition for jobs benefits employers, who then pay less, and second, the low cost of this new labor causes businesses to rely on it in order to compete, displacing those that they would otherwise hire.

Consider Silicon Valley. There are two classes here, code monkeys and experts, with the latter arising selectively out of the former. Code monkeys do most of the bulk work which involves forcing finicky computer systems to address details of a larger task. Experts design the procedures that accomplish the task and build the basic structure.

With the advent of H-1Bs, the code monkey caste shifted to accommodate the new reality of a lower average salary. This in turn meant that no one could survive as a code monkey anymore, but had to be an expert, so as a result we have seen a proliferation of frameworks, programming languages, and specialized software systems so that more people can have expertise.

In theory, the economy would not be a zero-sum game, so that if someone invents a new system and finds a way to make money at that, it does not take from others. In reality, however, careerism causes a false expansion of the industry because these additional methods are not needed, but must still be supported by the same pool of wealth.

The same can be observed in a grocery store. Every company wants to have a product in the mustard aisle, apparently, which leads to there being two hundred different mustard jars on the shelves. Each careerist wants his career to advance by having a successful product, but they are simply dividing the pool of purchasers further.

Where this becomes murky is the realm of trends. If artisanal mustard becomes a fad, then there will be more buyers for a short term, followed by a sudden lack of buyers when the trend ends. Sort of like how everyone and their dog opened an aerobics studio in the 1980s, everyone makes mustard… and then the market, flooded with options, responds by concluding that this trend is no longer valuable.

Supply and demand applies to attention as well as physical products, and the normal level of an industry or product type — that is, outside of trends — forms a type of commons, from the classic Garrett Hardin essay “The Tragedy of the Commons”:

Picture a pasture open to all. It is to be expected that each herdsman will try to keep as many cattle as possible on the commons. Such an arrangement may work reasonably satisfactorily for centuries because tribal wars, poaching, and disease keep the numbers of both man and beast well below the carrying capacity of the land. Finally, however, comes the day of reckoning, that is, the day when the long-desired goal of social stability becomes a reality. At this point, the inherent logic of the commons remorselessly generates tragedy.

As a rational being, each herdsman seeks to maximize his gain…the rational herdsman concludes that the only sensible course for him to pursue is to add another animal to his herd. And another; and another… But this is the conclusion reached by each and every rational herdsman sharing a commons.

Therein is the tragedy. Each man is locked into a system that compels him to increase his herd without limit–in a world that is limited. Ruin is the destination toward which all men rush, each pursuing his own best interest in a society that believes in the freedom of the commons. Freedom in a commons brings ruin to all.

Adding more participants to an industry does not raise the number of consumers or the value of the product; all it does is lower the costs for the industry, which in turn forces a proliferation of useless parallel competition because careerists are trying to escape the effects of those lowered costs.

When Joe Executive decides that his company must release a new form of artisanal mustard (or perhaps we should say “indie” mustard) then he hopes to capture market share from other companies selling mustard. In the process, he joins a vast surge of others doing the same, and this careerism produces radical effects.

Consumers, faced with too much choice, tend to separate into two groups. Those who are fanatical about mustard will read up and buy the best; for the average person, however, the task becomes a negative one because they are not particularly invested in mustard, but need something for the table.

This causes them to gravitate toward whatever is the safest option, which is signaled by a very simple thing: whatever most people are already buying. Greater variety leads to greater conformity, which is why big American brands of beer and mustard are popular despite not being cheap and not being really all that good.

In theory the beer aisle would be a place of plentiful competition and so each beer would be ranked by quality. However, most people cannot discern quality well, and are overwhelmed by the options before them, so they grab what everyone else they know is buying.

This creates a situation where a mediocre big name beer does not sell for half what an import does, but two-thirds of the price. The mediocre beer is proportionally more expensive consider how low quality it is. Admittedly, taxes and regulation play a part here as well; taxes raise the minimum price of any beer, and regulations penalize small manufacturers, who pass that cost on to a relatively small group of consumers, where big firms can divide that cost by more customers and therefore have a lower per-customer cost.

The tragedy of the commons as rendered by careerists, then, causes a concentration of industry in a few large participants, who then raise prices proportionately despite maintaining a surface cost that seems low. Another good example can be found in the snack aisle of your local grocery store; despite there being approximately forty options in our local store, for example, the “big brands” cost twice as much as the store brands and are the biggest sellers. Do you like paying $4 for a 13oz bag of potato chips? Obviously, the store brands can deliver for half of that or less, but despite that and many other specialized options, most consumers are still paying quite a bit for a product that costs less to make because of economies of scale and requires zero R&D. This type of “rent-seeking” behavior is in theory displaced by more market competition, but in reality, more competition seems to increase consumer confusion and result in a concentrated market.

In our labor market, both skilled and unskilled, the same thing has happened. When we dump in lots of new options at the lower end of both silos — unskilled and H-1B — it forces those who previously occupied those spaces to diversify markets in order to find work at above the cost that an immigrant, having lower startup costs for education and childhood in the third world, would demand. This in turn makes markets fragile because it creates a trend arc where new ideas boom, options proliferate, entropy results, and then a few big companies dominate the market through the consolidation caused by “choice exhaustion” or “analysis paralysis” on the part of their consumers. When those consumers are business-to-business, this dilemma may be exacerbated by the lowercase-c conservatism of executives and de facto bureaucrats making these choices.

Part of the great fragility of the American economy, and the even greater fragility of the Chinese one, can be seen through the rise of megacorporations like Amazon and Alibaba in the “service economy,” or one in which we participate through providing online services to consumers. The problem with this model is that it is exclusively demand-based, meaning that it assumes that consumers will continue to purchase what are essentially luxuries, or non-essentials, at the same rate they have in the past, ignoring that even larger trends have a trend arc. In a worst-case scenario, these giant businesses will gobble up all the others in their industry during market concentration driven by cheap labor, and will then fail, leaving consumers with fewer options at the same time the economy absorbs a huge loss of phantom value.

In parallel to immigration, globalism has driven us to the state of being a service economy because our manufacturing costs — high because everything in the first world costs more, but further blighted by unions, lawsuits, regulations, education/certification costs, and higher worker mobility — cannot compete with the lower costs of labor in foreign countries and cheap international shipping. The entry of those foreign workers into what is effectively our labor market created the same displacement that immigrant labor does, and drove the lower middle class out of its customary occupations (which they probably realized was a downside of the new maids and lawn services) into areas where it may have been out of its depth. Its response was to create a new services industry that is based entirely on first world people having disposable income and lots of free time at work to spend on the products of that industry, but since these services are low-cost luxuries, there is no guarantee that they will not succumb to the trend arc, as signs already indicate they are.

In another parallel, the service industry pattern mirrors our welfare state. Government takes money from the top, and dumps it on the bottom, causing those consumers to spend more on goods and services, which “primes the pump” by accelerating the passage of money through the economy. This classic demand-based economic approach creates a different type of inflation because it produces industries dependent on government, which then weakens the market by creating essentially a subsidy industry within every industry. Since the early 1960s, the welfare state has joined third-world immigration and global shipping in both reducing wages and subverting our industry, which makes not only wages less valuable but investments more volatile.

At this point, much of the Western economy focuses inward. Our service economy looks toward luxuries; our banking sector focuses on re-financialization, or the selling of debts and options. There is no longer a drive toward creating value-added products where we take raw materials, convert them into objects, and then make those objects more valuable through support services. Instead, we are moving money in a cyclical pattern, importing cheap labor to sustain us by pocketing the difference in wages, and then using government as a sort of meta-industry that then subsidizes consumers to keep this process going. This appears to be a common problem in aging superpowers, much as it once blighted England and Rome, in that we enter a death spiral because we must sustain our vast bulk and have run out of foreign conquests to bring in more actual wealth.

This means that the experts are wrong: not only is immigration not good for the economy or American workers, but it is part of a fatal process by which our empire chooses to exit this world. The only plausible solution would be the opposite of what we are doing; if we were to downsize radically and eject low performers, then re-invent an industry that uses globalism to our advantage by selling our products worldwide, we could survive this at the same time that other empires will find themselves collapsing because of it. That however would require us to remove the welfare state, switch to supply-side economics, and end diversity, which seems implausibly unpopular right now but is gaining favor as people perceive that this will be necessary for us to avoid collapsing with our empire.

Tags: america, demand-based economy, H-1B, immigration, re-financialization, supply-side economics, tragedy of the commons, welfare state