Welcome to the Diversity and Socialism Recession

As default looms on the horizon, you are going to hear a lot of non-solutions about how we can “fix” the problem of having spent ourselves into bankruptcy while letting our infrastructure and institutions rot. Only one solution exists, and that is ending the diversity and socialism that got us here.

In the West, we hide our socialism behind two terms: “mixed economy” and “entitlements.” A mixed economy is based in free markets but layers on high taxes to fund entitlements, or payments made directly to citizens. In turn, the economy adapts to the free stuff from government.

For example, when Walmart sees that most of its employees are living off of some kind of benefits (another term for entitlements) it adjusts its salaries downward to take into account the subsidy that these workers receive, since that is the new baseline.

Sort of like tare on a scale, the baseline appears in every calculation. In a “pure” system, it would be zero, but if there is money floating around from government, the new baseline includes that in its calculation.

This is why, for example, when a state government hands out a UBI of a thousand dollars a month, prices go up to match. When the minimum wage goes up by ten bucks, prices rise. The new baseline takes into account what everyone has at a minimum and what is required to keep them coming to work.

In the same way, although this is heresy to voters, costs are passed on directly to the consumer. If you tax a business, its employees, subcontractors, and suppliers, that added up tarball of tax gets tacked onto the cost of their goods and services. Consumers pay it from income which was already taxed.

Modern Western economies justify this process through “growth,” which is the core of the circular Ponzi scheme by which it taxes and redistributes the wealth to tax it again, which means that the total GDP must always go up and therefore, each dollar be worth a proportionately smaller share of the total wealth of the society, therefore becoming slightly devalued through “inflation.”

Over the past few years, the governments in the US and EU have intensified this process through COVID-19 subsidies and added greatly to their debt. In the US, the total debt has skyrocketed to $31.8 trillion in part driven by this recent surge in government spending:

America’s debt is now six times what it was at the start of the 21st century. It is the largest it has been, compared with the size of the U.S. economy, since World War II, and it’s projected to grow an average of about $1.3 trillion a year for the next decade.

The United States hit its $31.4 trillion legal limit on borrowing this past week, putting Washington on the brink of another fiscal showdown.

Few economists believe the level of debt is an economic crisis at the moment, though some believe the federal government has become so large that it is taking the place of private businesses, hurting growth in the process.

When even the Leftist mouthpiece The New York Times notices that you are deeply in catastrophic debt and that the mechanisms of this debt like fiat currency, quantitative easing, and entitlements constitute as much central control of the economy as happened under Communism, things are not well.

Our policies of centrally-controlled capital have resulted in a value drop of 40% to our currency, which has already inflated by a factor of ten since 1956.

[The nation’s money stock] took off in March 2020 as the Fed slashed rates and started buying trillions of dollars in bonds to help support the economy as the coronavirus pandemic started, ultimately mushrooming by $6.3 trillion – a 40% increase – from its level right before the start of the crisis.

As money supply rose rapidly into early 2022, so did inflation; since [the nation’s money stock] started a persistent decline last summer, inflation pressures have also receded.

For non-economists: the more money you print, the less of the whole value of the economy each unit measures, therefore you can buy less with the same amount of money. They call this inflation because it is demand-driven but really it is devaluation based on oversupply of cash versus the value that backs it.

Borrowing money prints money. Where there was previously no money, now because there is a debt, the presumption of money exists and therefore the markets act as if there is money there as they must. This inflates the currency.

Inflation has been consistently rising over time because entitlements spending creates false wealth in the Keynesian cycle of using markets to pay for socialist entitlements and then measuring that economic activity as if it generated other wealth.

Inflation increases the price of goods and services over time, effectively decreasing the number of goods and services you can buy with a dollar in the future as opposed to a dollar today. If wages remain the same but inflation causes the prices of goods and services to increase over time, it will take a larger percentage of your income to purchase the same good or service in the future.

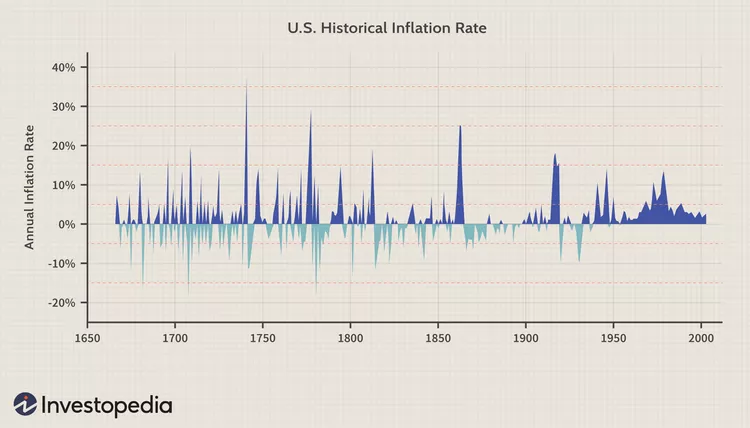

Here’s a chart of the inflation rate from the late 1600s to today. Notice that since the 1950s, the rate of inflation has been positive for nearly every year.

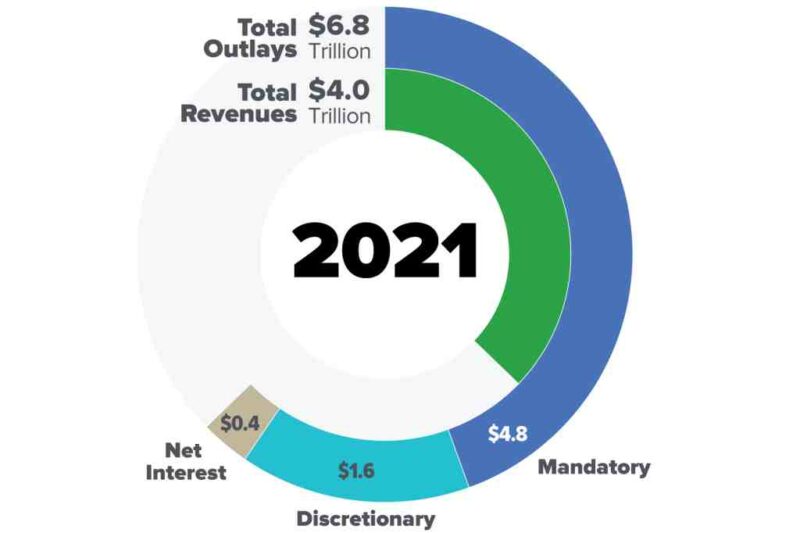

What caused the rise in inflation in the 1950s? As it turns out, entitlements spending has been the single largest area of government spending since after the second world war:

From 1946 on, spending averaged 22.5 percent of GDP and $9,287 per capita.

At the dawn of the 20th century, outlays amounted to $217 per person. By the 1950s, as the population doubled, spending swelled to over $4,340 per person. This level more than doubled to $11,909 in the first decade of the current century.

Not only did this spending previously barely exist, but the postwar years expanded it, and the 1960s turned entitlements spending into an exponentially-expanding obligation which essentially swallowed up our budget:

In 2010, entitlement spending had grown to be almost 100 times higher than it was in 1960; it has increased by an explosive 9.5 percent per year for 50 straight years. Entitlement transfer payments to individuals (such as for income, healthcare, age, and unemployment) have been growing twice as fast as per capita income for 20 years, totaling $2.2 trillion in 2010 alone—which was greater than the entire gross domestic product of Italy and roughly the same as the GDP of Great Britain.

The social programs of the 1930s did not really kick in until after the war when we had a surplus, and were expanded in the 1960s during the Civil Rights movement, causing real wages to drop to a standstill as taxes for socialist entitlements devalued the currency:

After adjusting for inflation, however, today’s average hourly wage has just about the same purchasing power it did in 1978, following a long slide in the 1980s and early 1990s and bumpy, inconsistent growth since then. In fact, in real terms average hourly earnings peaked more than 45 years ago: The $4.03-an-hour rate recorded in January 1973 had the same purchasing power that $23.68 would today.

While politicians were trying to keep the leaky ship of state afloat by moving money around, most notably from social security to pay for other entitlements and even raiding Medicare once or twice, the money that we should have been spending on infrastructure was spent on entitlements instead:

The debt that has been accounted for is the $15.6 trillion held by the public in the form of US Treasury bonds. The debts that have not been accounted for include the deferred costs of maintenance on roads, water systems, and 54,560 structurally deficient bridges, as well as the yet-to-be-built low-carbon energy systems necessary to mitigate the catastrophic effects of climate change. And these are just two broad examples.

So, just how much hidden US debt is there? At this point, we must rely on rough estimates. For example, according to a 2016 reportfrom the American Society of Civil Engineers (ASCE), upgrading the country’s crumbling infrastructure would cost $5.2 trillion. And, according to a 2014 International Energy Agency (IEA) report and our own calculations based on the US share of global CO2 emissions, transitioning to a clean-energy system will cost an additional $6.6 trillion. All told, that is $11.8 trillion in unaccounted-for non-inflation-adjusted liabilities.

In other words, we have publicly-held debt in the form of bonds and other loans, including the “quantitative easing” done through creation of private debt through companies like BlackRock, and then a shadow debt required to bring our facilities to the point of function again.

Three-quarters of our money goes to entitlements spending which is the major source of our debt:

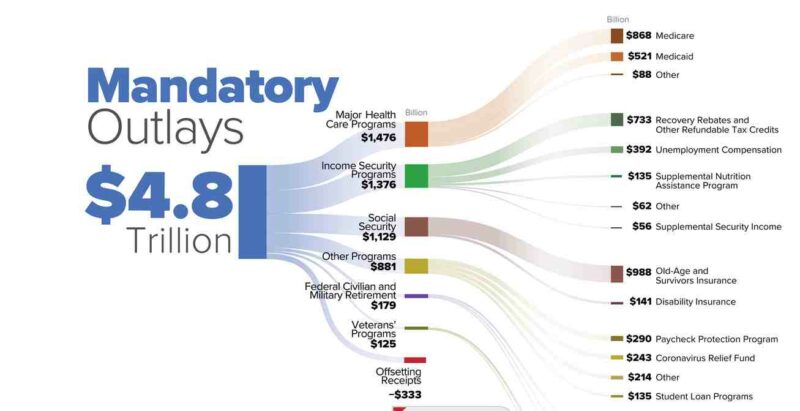

If you look more closely at this spending, you will find that these programs are anti-poverty and anti-racism entitlements that comprise the bulk of the budget:

Healthcare, welfare, and social security make up the majority of our spending, dwarfing the military and any other line item we have. These are the result of laws passed long ago, edited by the courts to have almost no limits, which expand every year and contribute the majority of our debt.

In other words, as our current Regime approaches default, consider how it got there: the socialist-style programs adopted to end poverty and increase racial equality destroyed the United States, and now it has no hope of coming back and restoring its infrastructure to first-world standards.

Despite the onrushing wall of debt, default, and disaster, the American government — much like governments in Europe — has doubled down on diversity because in the postwar world, this is seen as the foundation of our legitimacy to rule:

Republican congressman Patrick McHenry (N.C.), now the chairman of the House Financial Services Committee, announced earlier this month that there would be six subcommittees—and all of them will count advancing “diversity and inclusion” as one of their top priorities, according to the committee’s announcement.

The Subcommittee on Capital Markets, led by Republican Ann Wagner of Missouri, for example, will identify “best practices and policies that continue to strengthen diversity and inclusion in the capital markets industry.” And the Subcommittee on Oversight and Investigations, led by Republican Bill Huizenga of Michigan, is tasked with making sure there is “agency and programmatic commitment to diversity and inclusion policies.” No other specific oversight focuses were listed.

Diversity and inclusion, two members of the Diversity, Equity, and Inclusion triumvirate now commonly referred to as DEI, have become an obsession for Democrats and left-wing activists in recent years. Republicans won a narrow majority in the midterm elections at least in part due to promises that they would end the Democrats’ DEI craze.

What constitutes the Uniparty? Obviously, its addiction to socialism and diversity. It spends all of your money on these. It cannot abandon them for fear of making itself illegitimate. Despite being wildly in debt, it keeps increasing the spending on these dead-end programs.

While some economic signs are hopeful, we are headed into a permanent morass. Like Communism, no society can survive when its marginal costs outweigh its production, and the more the former rises, the lower the latter falls.

Most likely, the Leftists of the world are ready for war. They want war in Europe, which will kick off war in Taiwan, similar to the past world wars. Only by destroying the economies of the world can our debt-laden socialist system rise again, they think, and we sacrificed it all for the diversity.

Tags: debt, entitlements, inflation, medicaid, medicare, social security, welfare