Stagflation

If your wealth is held in stocks, bonds, and ownership of companies you probably find the economy pretty good right now.

After all, the numbers keep going up, and as speculators buy like mad to try to stay above inflation, your properties become valuable to those who want to trade in them.

Of course, at some point this comes to an end and the inevitable recession appears. The speculators stop buying like mad and the prices slowly drop back down. False value has been reclaimed by the markets.

Right now they like to talk about “inflation.” They did that in the early 1970s, too, before they could not hide what was going on, which is actually devaluation. That also happened under 0bama.

Devaluation is what happens when your government spends too much money on stimulus and ends up as a result making that money worth less because it is moving more “freely” through the economy.

Instead of inflation, we have stagflation, or what happens when government spends too much money and crashes the value of the money. At first, the flood of money stimulates speculation; over time, the money becomes less valuable because speculators are not investing in anything long term.

This produces Biden’s Carter-style permanent economic malaise:

Regulatory changes, ostensibly aimed at improving long-term sustainability and market fairness, have inadvertently escalated operational costs for businesses. These increased expenses are inevitably passed on to consumers, adding fuel to the inflationary fire.

Compounding the issue is the federal government’s relentless expenditure. A bid to stimulate economic activity through government expansion creates an opposing force against the Federal Reserve’s attempt to stabilize prices. However, this fiscal largesse, particularly in an election year, is double-edged. Promises of increased social welfare and economic support measures, while politically popular, exacerbate inflationary pressures by injecting more spending.

In the labor market, the inflationary cycle perpetuates as employees demand higher wages to offset the rising cost of living.

When governments spend money, you get the same problem as with centralized command economies like in Communist states: the value of each unit of currency declines because the value backing them, the productivity of the nation, has been reduced. Costs go up and value goes down.

Command economies like government stimulus provide inexact responses to market conditions. Someone making a rule for the whole country from an office in the capital city does a less precise job than free markets or local authorities can do, which tends to slow down productivity while raising costs.

The Communists perished through stagflation, too, with the added problem that reward-before-production systems like socialism penalize production, and end up with more takers than makers. In democracy, we use egalitarianism to justify taking from the makers to give to the takers, just like in socialism.

When that happens through New Deal, Great Society, and Green New Deal style programs, the end result is a crash in value. This puts us in the cycle that started in 1913 when America adopted a federal income tax. When those taxes and other costs rise too high, the economy rises at first then stalls hard.

This is what we call stagflation. It is short of a recession, which is measured by “growth,” a metric complicated by the fact that the numbers are higher when the currency is worth less.

This should surprise absolutely no one, since the formula for stagflation is well established.

The 1970s saw growing federal budget deficits boosted by military spending during the Vietnam War, Great Society social spending programs aimed at fighting poverty, and the collapse of the Bretton Woods agreement.

Meanwhile, unemployment had exceeded standards set in two prior decades, and growth was uneven. The economy was in a recession from December 1969 to November 1970 and again from November 1973 to March 1975. When not in a recession, the economy saw real gross domestic product (GDP) grow at a rate of above 5% between 1972 and 1973 and mostly above 5% between 1976 and 1978. This set the stage ahead of oil price shocks that would curb growth while fueling inflation.

In November 1979, only 19% of Americans were satisfied in the U.S. (In comparison, Americans’ satisfaction with the national trend in this poll peaked at 71% in 1999.) In the 1970s, lower living standards and declining confidence in economic policy were commonplace.

Many people want to blame the federal bank, but the brutal truth of the situation is that the federal bank is a means to an end, and that end is the tax-and-spend cycle that drives “growth” on paper but reduces the value of currency, penalizing those who make salaries or wages instead of deriving their wealth from investments.

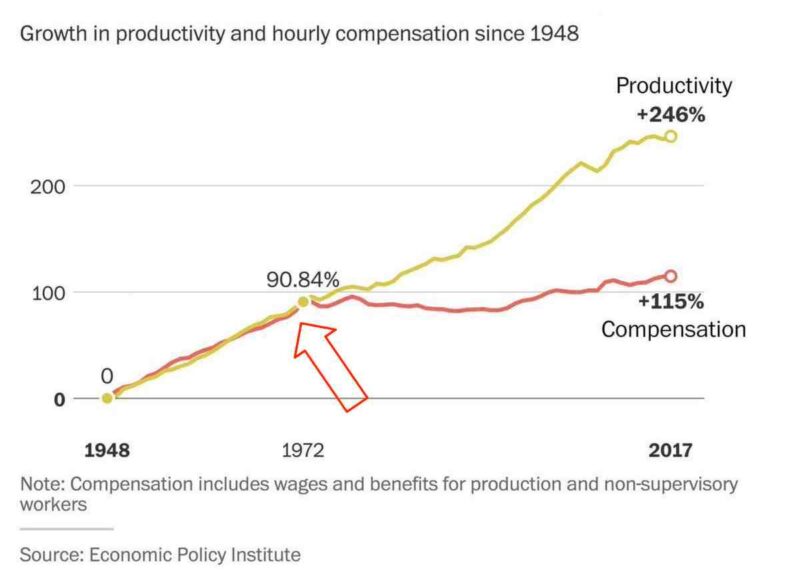

Consider the across-the-board financial disaster that has visited America since we adopted socialist entitlements systems:

Modern war added to the problem because it is much more expensive than sending a bunch of guys with swords or guns off on boats to fix the other guy. However, the military budget is dwarfed by the cost of domestic entitlements, which are payments made directly or in-kind to citizens.

Many want to talk about the gold standard in this context, but that also is a proxy, since getting off the gold standard merely allowed us to manipulate our money in order to make it seem like we could afford entitlements.

Getting off the gold standard became necessary because of the debt created by entitlements, since that was decreasing currency value in the stagflation pattern outlined above:

The international monetary system after World War II was dubbed the Bretton Woods system after the meeting of forty-four countries in Bretton Woods, New Hampshire, in 1944. The countries agreed to keep their currencies fixed (but adjustable in exceptional situations) to the dollar, and the dollar was fixed to gold.

In the 1960s, European and Japanese exports became more competitive with U.S. exports. The U.S. share of world output decreased and so did the need for dollars, making converting those dollars to gold more desirable. The deteriorating U.S. balance of payments, combined with military spending and foreign aid, resulted in a large supply of dollars around the world. Meanwhile, the gold supply had increased only marginally.

The structural problem, which has been called the “Triffin dilemma,” occurs when a country issues a global reserve currency (in this case, the United States) because of its global importance as a medium of exchange. The stability of that currency, however, comes into question when the country is persistently running current account deficits to fulfill that supply. As the current account deficits accumulate, the reserve currency becomes less desirable and its position as a reserve currency is threatened.

In other words, we went off the gold standard because unions raised the cost of labor and therefore imports became a fact of life for us:

By the mid-1950s, unions in the US had successfully organized approximately one out of every three non-farm workers. This period represented the peak of labor’s power, as the ranks of unionized workers shrank in subsequent decades.

The decline gained speed in the 1980s and 1990s, spurred by a combination of economic and political developments. The opening up of overseas markets increased competition in many highly organized industries. Outsourcing emerged as a popular practice among employers seeking to compete in a radically changed environment.

Unions come from the same socialist impulse as entitlements.

Both end the same way, which is in raising costs above productivity, at which point the nation begins to operate at a net loss.

Unions do this to industries such as the auto industry, which once led the world but now exists on federal aid life support.

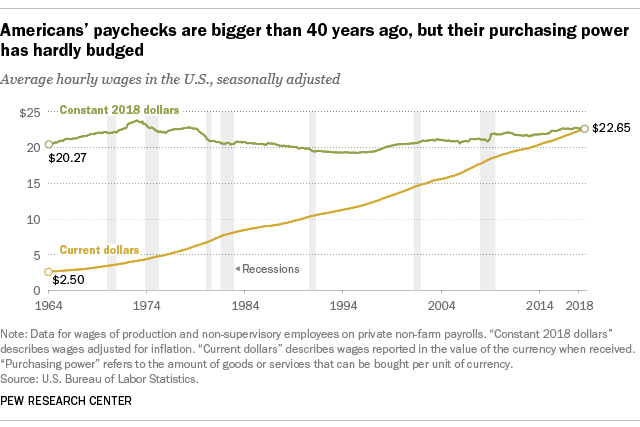

This creates a permanent malaise where the numbers go up but because the currency is worth less, purchasing power goes down:

After adjusting for inflation, however, today’s average hourly wage has just about the same purchasing power it did in 1978, following a long slide in the 1980s and early 1990s and bumpy, inconsistent growth since then. In fact, in real terms average hourly earnings peaked more than 45 years ago: The $4.03-an-hour rate recorded in January 1973 had the same purchasing power that $23.68 would today.

It turns out that TANSTAAFL (there ain’t no such thing as a free lunch) is true; the free stuff from government (“fisgie”) just delays the time when the piper must be paid.

Like insurance, unions, property taxes, and other collective reward schemes, the looters in charge of democracy are stealing from producers to reward takers.

That in turn creates a cycle where false value is created in order to stay ahead of the rising cost of the looting, which forces us to adopt fake money schemes.

The Right tends to target anything but the rot at the core of America, which is egalitarianism. Our founding fathers believed in competition, not equality.

They saw equality of birth (in the Declaration of Independence) and equality under the law (in the Bill of Rights) as being the limits on equality.

Similarly they imposed limits on democracy through a tiered system of representatives.

This has been forgotten as waves of migrants, first the Irish and now the third world, have been normed and then resumed voting as they are genetically programmed to do, i.e. for the type of societies from which they came.

This is why diversity is the core of American politics: it is necessary to keep the socialist system alive which was started back in the 1860s with the civil rights agenda.

Civil rights, unlike the natural rights we had under the Bill of Rights, creates an affirmative need for government to situate all citizens equally.

From that has come the largest outpouring of egalitarian legislation in history, touching everything from taxation to divorce.

Until Republicans are willing to confront that beast, they are not going anywhere. ProTip: you will not find mention of this in any mainstream conservative sources, and you should ask yourself why.

Tags: circular ponzi scheme, civil rights, inflation, natural rights, socialism, stagflation, unions