Cutting Entitlements Will Be Required To Solve The National Debt

When America adopted its socialism-within-capitalism programs like the New Deal and Great Society, conservatives at the time pointed out the fatal flaw of socialism: by making people depend on government, it makes them inert and unable to choose direction.

They argued that once entitlements benefits — those paid directly from government to citizens — entered the picture, people would stop thinking in terms of what to do with their lives, and start looking for something offered by government, career or welfare, for a future.

Over time, they would lose the ability to make independent choices. They would see life as a series of offerings, and choose whatever fit best, and if there were none, do nothing. In turn, government would become more powerful and grow.

Decades on these predictions have become true, as they always do, as has the problem of collective reward systems, which is that when you reward the worst along with the best, you get people who put in halfway efforts and expect full reward.

In turn, our government has become progressively more indebted, with the total now hanging out at around $22 trillion dollars, with possibly more unfunded liabilities in the wings. With a yearly budget of approximately $3 trillion, there is no way for us to pay this off without massive cuts.

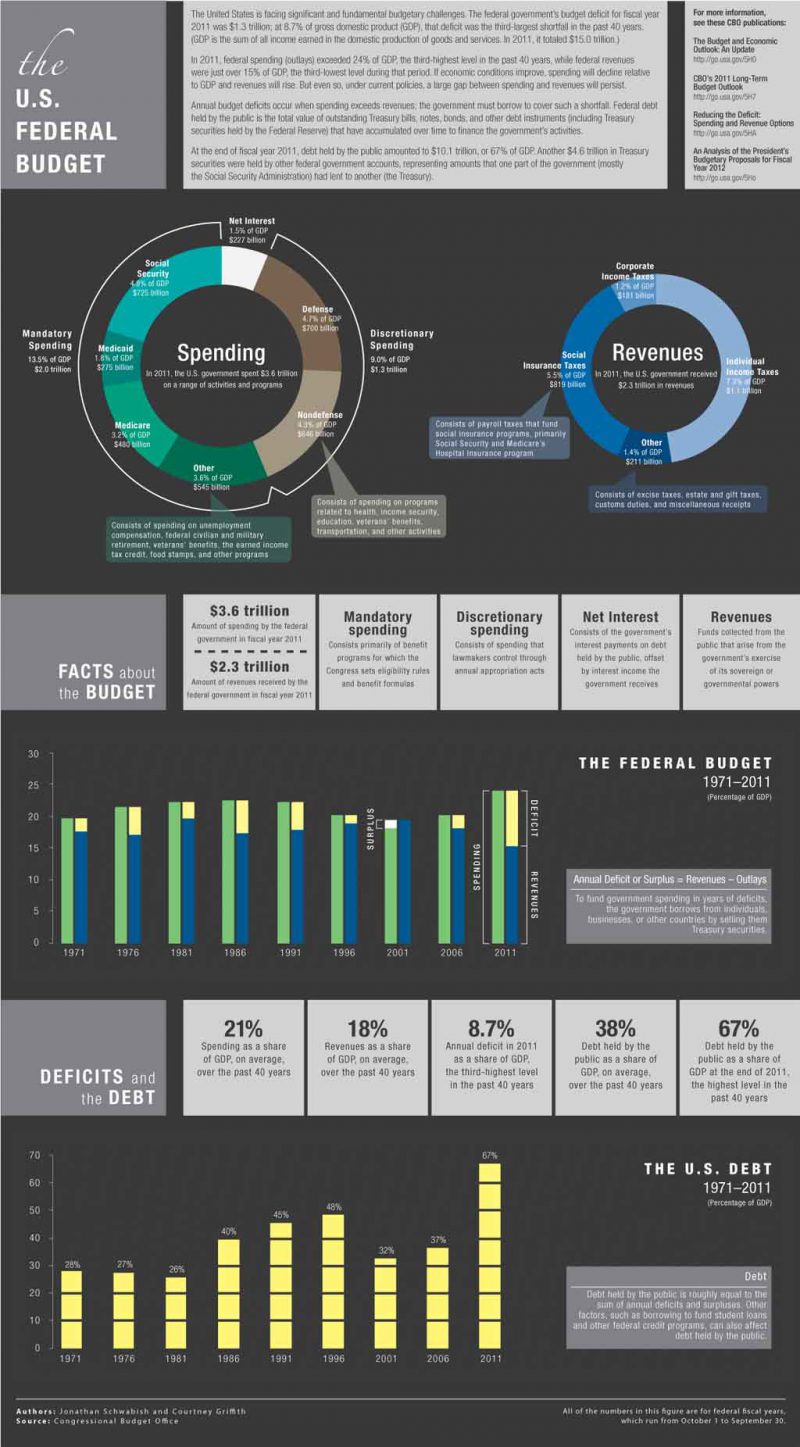

To every observer, it becomes obvious that those cuts will have to happen in the entitlements sector, because looking at a budget breakdown reveals the majority of our budget goes to these programs:

Infographic from the Congressional Budget Office.

Our costs break down along the following lines:

- Social Security (4.8% GDP/$725 bn)

- Medicaid (1.8% GDP/$275 bn)

- Medicare (3.2% GDP/$480 bn)

- Other benefits (3.6% GDP/$545 bn)

- Non-defense benefits (4.3% GDP/$646 bn)

- Defense (4.7% GDP/$700bn)

- Net interest (1.5% GDP/$227bn)

Other than a small slice of “Other benefits” and “Defense,” the entire budget is consumed by entitlements and the interest paid to support our debt. When people say that the world has shifted Leftward since 1945, consider the above: our government is functionally socialist, but exists through the taxes paid by ordinary people, which has raised the costs of every aspect of life to levels that would have been hostile to our grandparents.

Taxes get passed along to the consumer by business. If business must pay high property, income, and gains taxes, they calculate that into the cost of the goods and services that they sell, and charge more. This means that the consumer gets taxed multiple times, paying taxes once for goods and once on the income used to buy them.

Around here a new slang has emerged which is “cash price.” If you hire someone to hang new gutters on your house, you ask, slyly, what the cash price is, after he has given you the official estimate. If he is in the know, he will cite you a much lower price and do the work off the books, which means that he will not pay taxes for it and you will get a much better deal. A worker with enough regular customers can do most of his work this way, which allows him to keep business and personal income low while actually having a good deal more money.

This system has survived only because we are prosperous. The top 20% of earners pay 84% of the income tax, which means that they are passing on costs to customers, paying themselves high salaries, and concentrating wealth because taxes do not hit them as hard as they hit you. Assuming that everyone paid a quarter of their wealth in taxes, that leaves a millionaire with $750k but a middle-class home with $45k. Just as $500 in costs means a lot more to a poor person than a rich person, taxes are better borne by the wealthy, as they still take home massive amounts of income.

Under this regime, many get rich, but generally only those willing to be self-serving enough to pass on every cost that they can to customers and society at large through externalized costs like pollution and social disorder. The horrible cycle of working long hours, having a good paycheck, and then seeing it all evaporate has created an attitude of a desperate need for wealth in the country, which has in turn made a system where a few get amazing results and everyone else stays wealthy enough to have some extra income but never enough to get out of the cycle.

In theory, you can work your whole life and then retire with Social Security checks arriving monthly and health insurance from Medicaid/care, but in reality, these often pay less than people think. The cycle continues until the grave.

These programs have made life worse, not better. Consider the abject failure of the Great Society programs:

It was supposed to help America’s poor become self-sufficient, and it has made them dependent and dysfunctional.

This is fact is illustrated most vividly by the “Anchored Supplemental Poverty Measure Before Taxes and Transfers*” (ASPMBTAT). This metric was devised to assess the ability of people to earn enough, not counting taxes and subsidies, to keep themselves and their dependent children out of poverty. The income required to do this varies by family size and composition, but, for a family comprising two adults and two children, it is $25,500/year (in 4Q2013 dollars).

The ASPMBTAT is the ultimate quantitative test of the success (or failure) of the War on Poverty, at least in terms of its stated objective. Shortly after the War on Poverty got rolling (1967), about 27% of Americans lived in poverty. In 2012, the last year for which data is available, the number was about 29%.

As a result of this cycle, the bills get higher and higher because we are producing more citizens who are entirely dependent on government. In order to fund this, we have sabotaged those who are not dependent on government with high taxes.

This has produced a tax-and-spend cycle which will ultimately end democracy:

But now, in its third century of existence, it is producing dysfunctional and potentially self-destructive forms of governance. The United States has been deadlocked in the monumental issue of its budget deficit and entitlements, unable to cut spending or raise taxes. Europe as a whole is no less fiscally bankrupt, and measures to restore its public finances are throwing the continent into economic depression and political upheaval.

To compound this error, our current crop of Leftists have suggested a new version of these programs which would cost $93 trillion to implement.

It is like stepping into unstable soil on a mountainside. Once you set one foot on the dirt, the ground falls out from under you, and there is no way to stop until you reach the bottom, probably traveling faster and a bit more beat up than when you started.

Tags: budget, entitlements, great society, green new deal, new deal, welfare